The Data Dilemma: Navigating Fraud Detection In AI With Financial Insights

In the ever-evolving domain of artificial intelligence (AI), a crucial element stands at the forefront of enabling sophisticated AI models to learn and make informed decisions: data training infrastructure. Central to this infrastructure are not just the GPUs that fuel AI’s capabilities but, more importantly, the data and the people behind its creation. The journey into advanced AI technologies, such as Large Language Models (LLMs) and multimodal data, underscores a burgeoning challenge—the creation of high-quality training data.

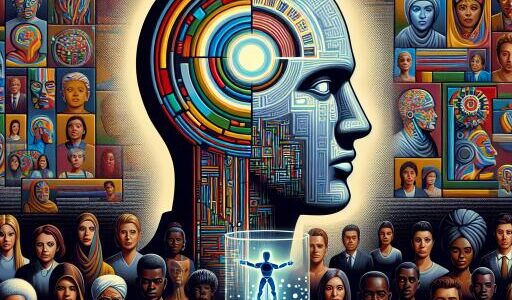

The task stretches beyond mere data accumulation. It involves a nuanced understanding of the demographic, cultural, geographic, and expertise variations necessary for accurately interpreting AI outputs—a feat not always achieved with precision. The integrity of data is pivotal for the efficacy and predictive accuracy of AI models. Skewed data collection methodologies, especially in sensitive sectors like healthcare, can significantly deteriorate a model’s utility, leading to misjudgments and, ultimately, misguided action plans.

The burgeoning Data for AI sector faces a formidable challenge in managing the complexities of creating accurate data amid soaring demands. This is mirrored in the financial services industry, which exemplifies the significance of robust fraud detection and Know Your Customer (KYC) systems. These systems are foundational not just for meeting regulatory compliance but for ensuring the indispensable trust and security that anchor the industry.

Financial institutions leverage advanced analytics and machine learning to discern and thwart fraudulent activities effectively. Practices like real-time transaction monitoring exemplify how continuous validation and a zero-trust approach are instrumental in navigating the landscape of ever-evolving fraud types, thereby maintaining data integrity for AI model training.

KYC procedures, aimed at verifying customer identities and assessing risk factors, further illustrate how rigorous validation processes are imperative for preventing financial malfeasances. The financial sector’s dedication to maintaining a fortress of security and integrity offers a blueprint for the AI domain in its quest for data reliability and model accuracy.

As AI continues its ascent, the urgency for quality, reliable data echoes louder, pressing the need for methodologies that safeguard data authenticity. Employing advanced analytics, rigorous identity checks, and fostering a culture steeped in transparency and accountability becomes paramount. Investment in ecosystem intelligence, third-party assessments, and a commitment to vulnerability transparency will be critical to ensuring AI’s innovative yet trustworthy progression.

With the insights gleaned from the financial sector’s stringent fraud detection and KYC systems, the AI industry is poised to enhance data integrity and model performance. Emphasizing advanced validation, inclusive data practices, and a culture of innovation balanced with accuracy and reliability, the path forward is clear. To cultivate an AI future that is secure and equitable for all, prioritizing data integrity and fraud detection will be key.

As we strive to pave the way for a future where AI technologies are both groundbreaking and safe, the lessons from financial systems’ emphasis on stringent data verification and fraud prevention will undoubtedly be a beacon of guidance. Indeed, with these robust mechanisms in place, the AI industry can look forward to an era of innovation underpinned by trust and reliability.

The exploration into achieving a harmonious blend of technological advancement and data veracity underscores a compelling narrative. As we decipher the complexities of navigating fraud detection in AI, bolstered by financial insights, the journey promises a landscape where technology transcends, opening avenues for a future where AI is not just intelligent but is also imbued with a sense of ethical responsibility.