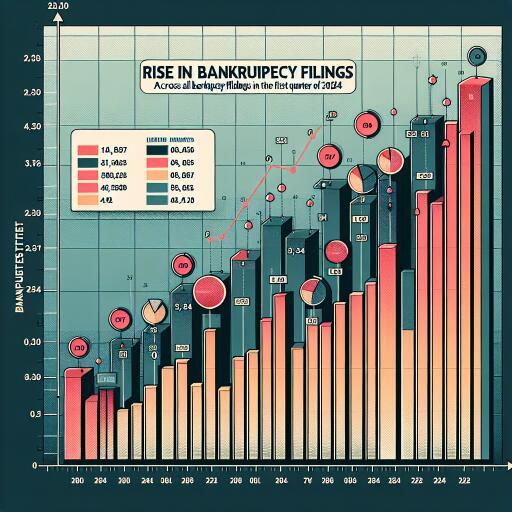

Surge in Bankruptcy Filings Signals Economic Strain in Early 2024

The initial months of 2024 have marked a significant upturn in bankruptcy filings across the United States, with figures climbing across various sectors. A detailed analysis paints a picture of a nation grappling with financial challenges, affecting entities ranging from individual consumers to large commercial corporations.

The beginning of 2024 has witnessed a notable 43% rise in Chapter 11 filings from commercial entities, skyrocketing from 1,325 in the first three months of 2023 to 1,894 in the same period of 2024. This surge forms part of an overall 22% increase in commercial bankruptcies, with the total count reaching 7,113, up from the previous year’s 5,820. It is noteworthy that Subchapter V filings, dedicated to small businesses, swelled by 30%, moving from 465 to 606 filings.

When it comes to the broader landscape, the total bankruptcy filings soared to 120,094, marking a 14% elevation from 105,497 filings in the first quarter of the previous year. The bulk of these filings were personal bankruptcy claims, which also saw a significant rise. Specifically, consumer filings rose by 13%, reaching 112,981 filings compared to the prior year’s 99,677.

Diving deeper into personal bankruptcy types, Chapter 7 filings, often used for liquidation, increased by 17% to 66,861. Meanwhile, Chapter 13 filings, which involve a repayment plan, went up by 9%, totaling 45,958 applications. This upward trend in filings underscores a broader economic strain faced by both individuals and businesses alike.

Experts attribute this rise in bankruptcy filings to several key economic pressures. The rising cost of funds and interest rates, coupled with decreased consumer spending and escalating housing costs, have put a strain on finances. Additionally, the depletion of savings previously bolstered during the pandemic has added to the financial strain for many, raising the number of those seeking relief through bankruptcy.

March 2024 alone saw a 5% increase in bankruptcy filings across the board compared to March 2023. This included a 3% increase in commercial filings and a significant jump in Subchapter V selections for small businesses, indicating a continued trend towards financial distress among American enterprises and individuals alike.

The surge in bankruptcy filings comes at a critical juncture for small businesses. A current provision allowing small businesses to opt for a more streamlined reorganization process under Subchapter V is set to expire in mid-2024. If this provision sunsets, the limit for debt eligibility will sharply reduce, making it tougher for small enterprises to reorganize under favorable terms. In light of these developments, there’s a push to maintain the increased debt eligibility limit to support small business restructurings and safeguard jobs.

Beyond the immediate statistics and legislative concerns, the rise in bankruptcy filings is a stark indicator of the economic hardships facing many Americans. From individuals struggling to keep up with personal debts to businesses trying to navigate an increasingly challenging economic landscape, the path forward demands attention and action. As the year progresses, all eyes will be on these trends and the responses from policymakers and economic stakeholders alike.

In conclusion, the significant increase in bankruptcy filings in the first quarter of 2024 provides clear evidence of the financial distress pervading across various sectors in the U.S. As legislation and economic conditions evolve, the trajectory of these filings will be crucial in understanding the broader economic health of the nation.